One of the main concerns for cryptocurrency holders is security. Whether it’s the security protocols in place at a custodial service or the security of a self-custody cryptocurrency wallet, there is always a threat of a misstep and coming home to find your funds gone.

Most services insure the funds in their custody in some way and by extension their customer’s funds are also insured. This, however, is only a remedy and does nothing to prevent losses in the first place. One of the solutions is multisignature.

What is multisignature?

Multisignature, sometimes called multisig or multi-signature, is a digital signature scheme, where multiple keys are required to sign a transaction. This has some advantages over custody using a single key:

- Divides the responsibility to more entities.

- Removes a single-point of failure, making it substantially more difficult to compromise an address.

- The loss of a single seed doesn't lead to loss of the wallet.

What networks support it?

On Bitcoin, multisignature has been supported since the introduction of P2SH in 2012. However, the process was not supported by any client for a long time and this secure method of signing transactions took some time to become mainstream.

The most common option is to use a 2-of-3 keys combination where 2 out of the 3 keys are required to sign any transaction. We can see how this can benefit cryptocurrency services and individuals when custodying funds. A transaction can’t be executed by one malicious user, if one key is stolen, the funds can’t be moved by the thief and losing a key does not result in a loss of funds. Some of the proposed use cases are:

- 1-of-2: Husband and wife petty cash joint account

- 2-of-3: Parents’ savings account for child

- 2-of-3: Improved hot wallet security for businesses

- 3-of-5: Low-trust donation address

- 1 OR 3-of-4: Distributed Backup

Check out more examples and a deep dive here.

Ethereum uses smart contracts as a proxy for multisignature transactions so the process differs somewhat there.

On the XRPL, multi signing is a built in function and works in much the same way as on Bitcoin where you can assign a M-to-N ratio of signers. Up to 8 addresses can be included in a signer list and you can control how many signatures are needed by using quorum and weight values.

How does it work?

Each blockchain address is required to authorize or sign its transactions using a master key, which needs to be kept safe by the owner of the address. In theory, the owner of the address is anyone who has access to the address’ master key. Inherently, a blockchain has no way of knowing if the rightful owner is actually making a transaction.

The process of signing transactions creates friction on two fronts. One, a master key could be exposed to discovery every time it is used. Two, owners need to take great care not to lose their keys. Keys can get lost in which case any funds on the address would be lost forever or they can get stolen which usually also results in a loss of funds.

Multisignature is a feature that allows more than one key to sign transactions by one wallet or address. These keys can be weighted and it’s possible to set a threshold, where only a proportion of keys is able to validate a transaction. If applied properly, multi signing is more secure than regular single key signing and can prevent losses of funds if one or more keyholders fail.

For example:

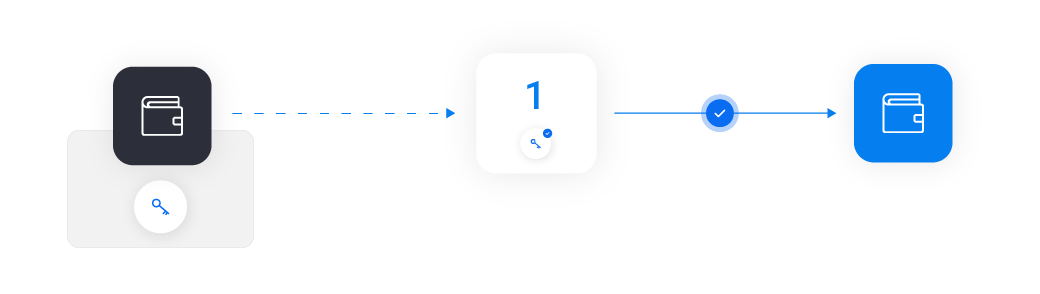

In regular circumstances one key is used to sign transactions by one address. This is called a key pair. If the key is lost, the funds are as good as lost.

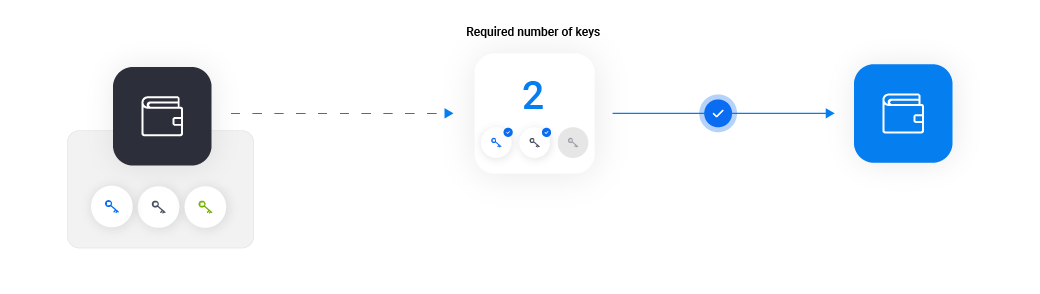

Multiple keys can be used to sign transactions by one address. A possible setup is that two out of the three keys are required to sign a transaction. If one key is lost for whatever reason, the funds can still be accessed with the use of the other two. This is a 2-of-3 setup.

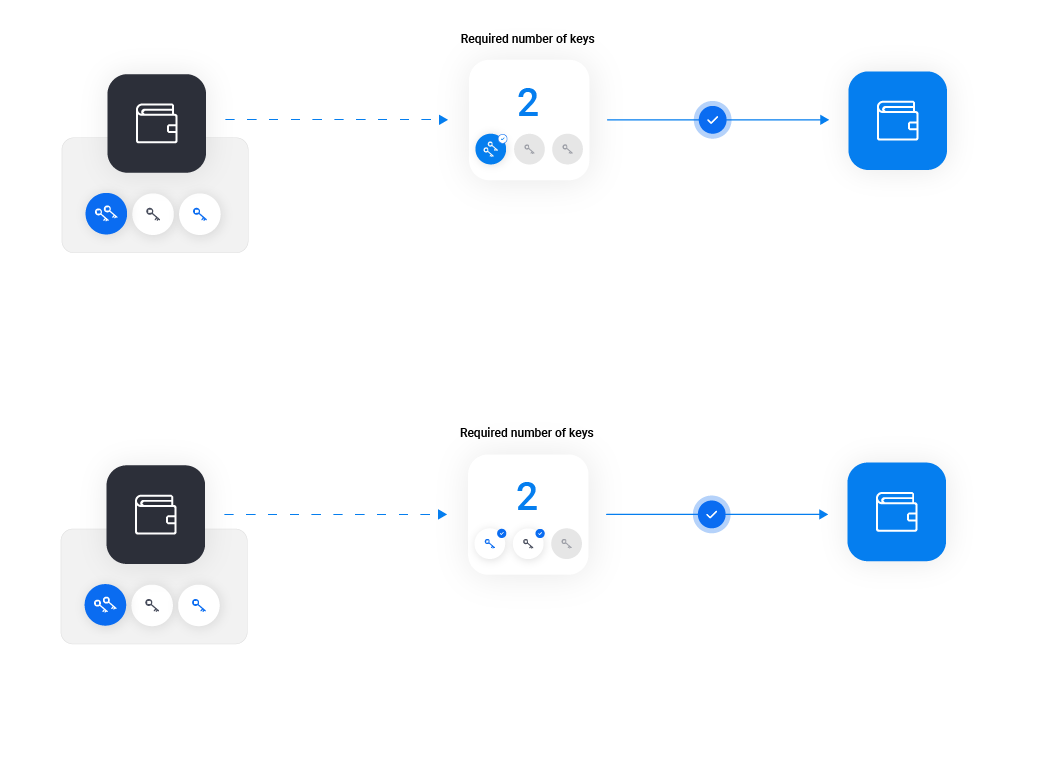

Multiple keys can be used and one key is weighted higher than the others. One key can sign transactions alone. This makes sense if you want one key to act as a recovery method. If both keys with weight 1 are lost, the final key can access the funds. This is a 1 OR 2-of-3 setup.

What are the disadvantages?

There are some clear advantages to setting up multisignature, but some drawbacks do exist.

First, the process can be a bit technical and there are significant risks if something goes wrong. Worst case scenario is a permanent loss of access to the account. There are some Bitcoin software wallets that can make the job a bit easier, but make sure these can be trusted and you know exactly what you are doing.

The other drawback is a lack of recourse or rollback if anything goes wrong. The regulations are still vague about many aspects of cryptocurrency. If the process fails you could end up with no way of reclaiming access to a wallet.

Conclusion

The drawbacks are that the process is relatively difficult for inexperienced users and not widely available on apps with a GUI. In general, the process is also irreversible, so in case something goes wrong there is no way of regaining access to the address. If you decide to try it out, make sure to inform yourself well about the process, use trusted software and make sure to have a back-up plan.

The benefits are obvious. It reduces the main security risk if a single key is lost or stolen. Your wallet is actually safeguarded better if there is more than one key and the keys are weighed properly. Stealing coins from a multisignature wallet becomes more difficult as more than one key has to be stolen. Losing access to funds also becomes less likely as you can create backups which can be stored safely offline. It is also possible to entrust some keys to another person or organization to keep them safe(er).