Staking cryptocurrencies is a way to earn money by holding onto coins that you already own. It's similar to interest earned on the bank account or dividends earned from owning stocks, except that staking cryptocurrency involves no loan and comes with no risk of losing your investment. You can stake any amount of cryptocurrency, as long as it's enough to meet the minimum requirements, and you'll receive a percentage of your coin holdings back as part of your reward.

What is staking?

Staking is a process by which you can earn rewards by holding coins in your wallet. It is an alternative to buying more coins or selling your existing ones, and it allows you to receive periodic payouts as long as you are staking the correct coin(s). The amount of rewards that you receive depends on several factors:

- The size of your stake (the number of coins that you are staking)

- Unstaking period (the period required to unstake your coins and earn rewards)

- The staking rewards (usually expressed in APY)

- Staking rewards are usually expressed in yearly percentages but you are usually able to compound your earnings by claiming your rewards periodically.

Staking vs. Mining

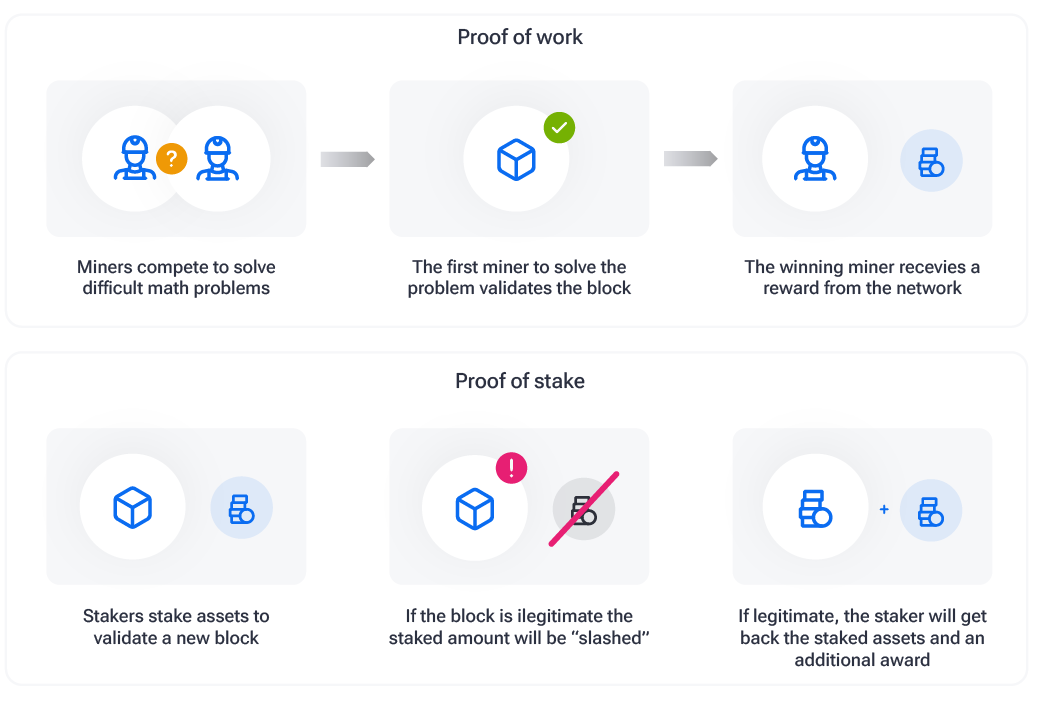

Staking and mining are often compared to each other, but they have significant differences. They are both used to validate transactions and secure the network. They both also provide an incentive for participation in the form of newly (minted) coins.

Staking is more passive than mining, in that it requires less time commitment and energy expenditure. Miners must rely on large amounts of specialized hardware to participate while stakers can do so with any computer that is connected to the internet.

The risks associated with mining and staking also differ slightly. Miners need to set up their mining rigs and constantly evaluate prices of hardware and energy. The barrier for entry is very high. Miners compete to become the first to “discover” a new block. The probability of finding a new block is proportional to the share of hashing power the miner operates on the network.

Staking only requires a certain amount of a token and some software that will automatically validate new blocks when required. The more coins a validator node holds or operates, the higher the chance that it will be chosen to validate the next block. The only risk is slashing. Slashing occurs when a staking node behaves maliciously. In those cases the node might lose some or all of its stake.

How do I stake my coins?

Staking is a way for you to make your coins work for you. You will need to download a wallet or app that supports staking and make sure that you're connected to the internet. Most networks, apps and wallets let you stake your crypto with just a few clicks and you are not required to do anything else most of the time. Such apps usually provide staking via pools like Everstake.

If you want to stake on your own, you will need a little more knowledge and run a validator node.

You can also simply start staking at some exchanges that offer such an option. In most cases, you only need to allow staking and you are all set. It is, however, possible you will not be able to withdraw your rewarded coins for a certain amount of time. This might happen on some exchanges when staking ETH, where ETH might be permanently locked in a smart contract where a new token is created to represent your stake, called ETH2 (it exist on the Ethereum 2.0 beacon blockchain). Staking on Ethereum is posible due to one of the upgrades (transitioning from proof of work to proof of stake).

What is a validator?

A validator is a node that is connected to the network and running a wallet with coins in it. There are two types of validators:

- Those who stake their coin, or “immature” coins, to help secure the network. They do this by taking part in consensus rounds, where they have an opportunity to vote for new blocks. The more coins you stake (your weight), the more likely your votes will be selected as winners in these consensus rounds.

- Those who run full nodes on their computers and servers around the world—these individuals help distribute information about transactions across the network so everyone can be informed about what happened during each block time period.

Validators are responsible for generating new blocks within each round which happens somewhere between 2 and 20 seconds depending on the network. Staking is less labor intensive than mining and no dedicated hardware is needed for the staking process.

What are the benefits of staking?

Staking is a great way to earn passive income. You don’t have to be online 24/7, and you can let your computer do all the work for you—you don’t even have to worry about security or price fluctuations since it’s all automated. It can be made even easier by using an app that provides access to a pool.

At times of declining prices, it could make sense to buy into a well established staking coin, set up your wallet for staking and forget about it until the next crypto bull run.

Does it cost anything to stake?

Staking is free except for any transaction fees required by the network to stake and unstake your coins. When claiming your staking rewards, you could be charged a transaction fee by the network but these should be minimal. You can further reduce the costs by claiming your staking rewards in less frequent intervals. Possibly only when you intend to sell. The downside here is that you will not be able to earn any compound interest if you claim rewards only at the end of your staking endeavor.

warning_amber Tax regulations and legislation is still fuzzy on the topics of mining and staking. Make sure to do proper research on any tax implications that apply to your staking rewards.

Is there a minimum amount of coins that I need to stake?

While each project will have a unique staking requirement, there are some general guidelines that apply to most. For example, most Proof-of-Stake coins require you to hold at least a certain amount of coins in order to be able to stake them. If you are staking for yourself, these requirements might be higher. If you are staking through an app that provides access to a pool, the requirement should be very affordable.

Can I stake any crypto?

The short answer is no.

Cryptocurrencies require some sort of consensus and validation in order to mitigate the double spend problem. Many cryptocurrencies use a consensus mechanism called Proof of Work (for example Bitcoin and Ethereum 1.0 and Dogecoin). That means the network spends a large amount of processing power to validate transactions. The process involves miners, contesting to be the first to solve a cryptographic enigma. The one that solves it gains the right to add the latest block of transactions on the blockchain and receives a reward.

Proof of Stake is a more environmentally friendly and less labor intensive process where validators need to put forward some or all of their balance for the right to create a new block. Malicious behaviour is punished by something called “slashing”. If a staking node behaves badly, their stake is taken away.

Conclusion

Staking is a great way to earn a truly passive income. You are able to stake your crypto on chain using an app or use a custodial service that will give you staking rewards. There are very few and very affordable requirements for staking compared to mining. Make sure to find a stable project with a sensible staking reward yield and use a reputable and secure app to keep your stake safe. Finally, when the time comes to unstake and sell off your earnings, stay on top of any applicable tax obligations to stay on the right side of the law.