One of the main promises of blockchain is to make money and payments universally accessible to anyone. We talked about the Internet of Value already but there is another effort called Decentralized Finance (DeFi) that has been gaining traction. It’s promise is the merger of traditional bank services and decentralized technology such as blockchain.

The goal is to create open alternatives to any financial service that exists today, accessible to anyone with at least a smartphone and an internet connection.

Disclaimer: This post is for informational purposes only and should not be viewed as investment advice.

Decentralized Apps

Like the Internet of Value, Decentralized Finance is not an isolated effort by one company or group. The shift to widely available, decentralized, flexible, interoperable and permissionless finance is being perpetuated by entities who build solutions mostly on blockchain.

For the most part DeFi is built on the Ethereum blockchain, where smart contracts enable automated actions when certain conditions are met. These smart contracts are key in making more complex transactions. A Dapp or Decentralized app is a program that is built on decentralized technology and is not controlled by a single entity. Some of the existing use cases for Dapps are lending, interest, loans, exchange, and betting.

The advantages of DeFi Dapps over traditional financial services are they are not managed by a single institution, the code and transactions are transparent, creation and participation is permissionless, user experiences are flexible, and Dapps are interoperable as explained in more detail here.

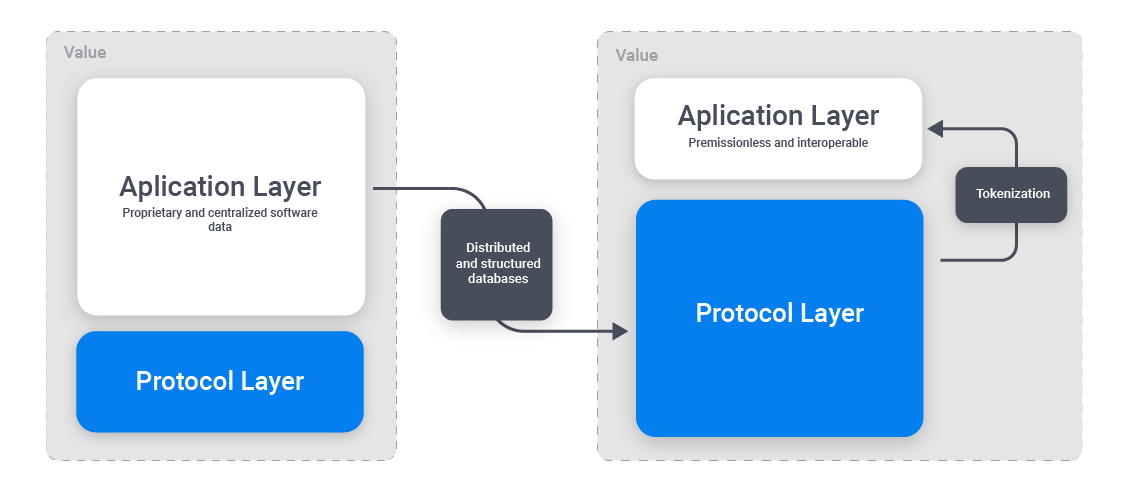

Another key difference between DeFi and the Web in its current form is that DeFi is a thin app layer on top of a thick protocol layer which is decentralized and permissionless. Traditional platforms are built the opposite way where a thin layer of open protocols (like HTTPS and TCP/IP) and open software supports a thick layer of proprietary and centralized software and data.

Market Capitalization

The market capitalization of DeFi is measured in total value locked in USD, which looks similar to how market capitalization is calculated for cryptocurrencies. There is a difference though.

The market cap of cryptocurrencies is based on the circulation (or available) supply and latest market price while the market cap of DeFi is calculated based on the total value of locked assets at the latest market price. You can check the market cap and ranking of the top DeFi platforms on DeFi Pulse or check an up to date list of Dapps here.

We can see that from its inception the market has expanded considerably, especially in the last few months, where the capitalization has jumped from just under $0.7B to over $6B.

Platforms

DeFi platforms are applications built on decentralized technology which make financial instruments easily accessible to anyone. DeFi Pulse distinguishes these categories: Lending, Derivatives, Decentralized Exchanges (DEX), Payments and Assets. Lending seems to be the most prominent category for now.

The most well known DeFi platform at the moment is MakerDAO, a decentralized credit platform which makes it possible for anyone to open a Vault and lock in collateral in order to generate Dai.

Compound is an algorithmic money market protocol which lets users borrow and earn interest against collateral. It’s built on the Ethereum blockchain and anyone can participate by adding their assets to Compound’s liquidity pool.

The last platform we want to talk about here is Augur which uses a native ERC20 token (REP). Augur is a decentralized peer-to-peer betting (oracle) platform that lets anyone create a market around the outcome of any global event. Participation is enabled by buying and selling shares in the event’s market. Users with shares representing the winning outcome can settle with Augur’s smart contracts or sell their shares to other users. You can read more about Augur in our recent blog here

Closing Thoughts

DeFi on the Ethereum blockchain is showing promise in markets other than those covered by ICOs in 2017, where only early-stage capital formation was tested. As we can see, there are so many other use cases with DeFi.

We talk about two seemingly distinct notions in this blog and our other entries. The Internet of Value and Decentralized Finance are both aiming to make financial instruments and services widely available, which implies some similarity. In some ways they overlap in their purpose but should, at least for now, be considered as two distinct efforts.

Stay tuned for more about DeFi and IoV.