What's for Tech Today? is our new interview series where we talk to industry leaders about FinTech, Blockchain, the Internet of Value and much more. Follow us on social media to get the latest insights from known industry experts.

We talked to Thomas Silkjær, former Creative Director and partner at 2K/DENMARK. An Internet of Value enthusiast, turned founder and CEO of xrplorer, an analytic, forensic and AML compliance company on the XRPL. Also known for his visualization of the XRP Ledger account activations and XRP Forensics, a precursor to xrplorer.

We address the topics of XRPL, Internet of Value, blockchain, bank digitalization and what is trending in the fintech industry and more.

We see so many financial apps, it’s hard to keep track. Mobile bank apps, payment apps, Google/Apple Pay, exchanges, portfolio and money management apps… What are the cool things right now and what apps do you use for your finance/crypto needs?

Most of the apps I use for finance are probably the classic palette: mobile banking, mobile payments, Apple Pay for contactless payments etc. But on top of that I am quite happy with using services like Nexo as a “crypto bank”.

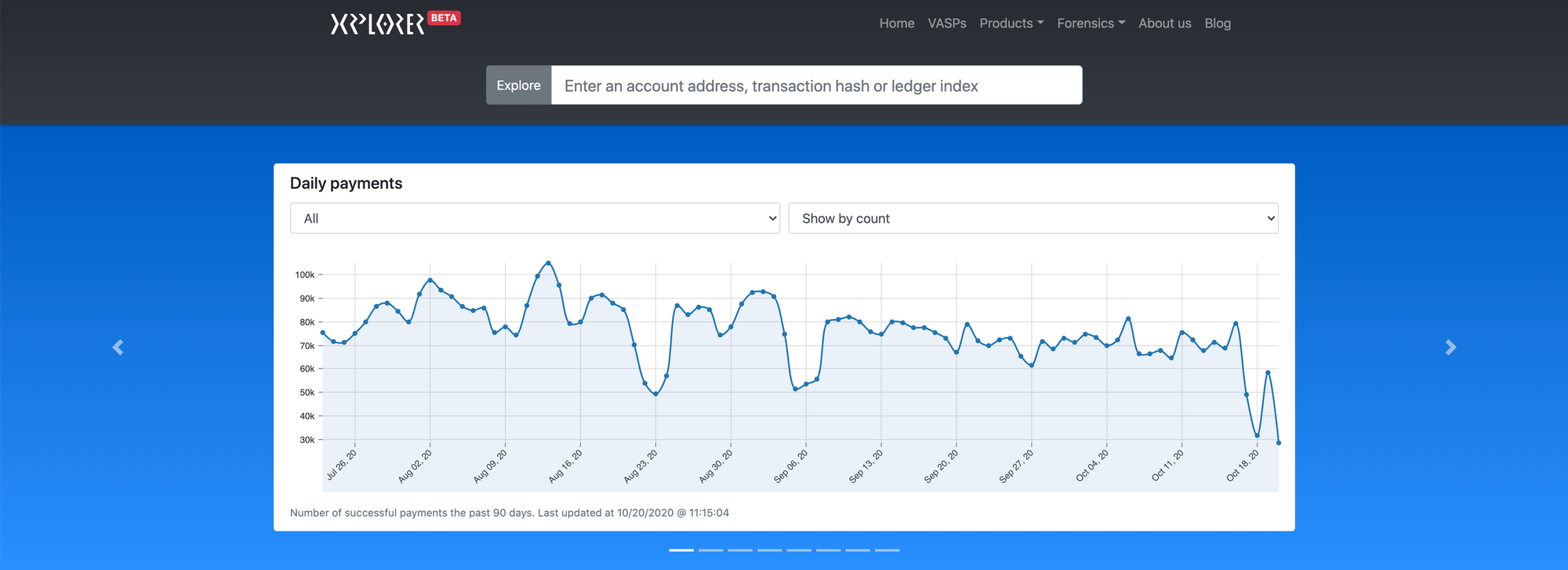

It seems like xrplorer came about from a sort of pet project. How is xrplorer doing and what are your plans for this endeavor? Are there any other side projects that you are working on?

That is correct! And it still is my pet project, only now the pet has grown a bit in size. The main value proposition of xrplorer for virtual asset service providers, is to help them, help their users. Both by preventing criminals from laundering money by selling it on their markets, but also the chance to warn users when withdrawing to a potential illicit account, e.g. a giveaway scam.

The plan is to grow the services from xrplorer, provide new tools, analytics and APIs, based on the input we get from our partners and can see a gap in the market for.

You have been pretty visible and active in the XRPL and crypto space. What are some interesting stories or insights regarding your time in the cryptocurrency or fintech space?

Like so many others, my journey started with an investment in digital assets – I have later realized that trading is not my forte. But the technology and the opportunities it brought along, really catched my attention, and took me down the rabbit hole of trying to grasp the technology.

Fortunately I have had the opportunity to travel a bit, and have met a lot of interesting developers and digital asset enthusiasts; and I haven’t met nearly enough yet, but just as I stopped at my previous job to start xrplorer full time, the pandemic closed the world down. But the best stories from my time in this space have been meeting like-minded people and daring to dream big. People who dare to run with the “what if’s”, and build things that challenge the “dinosaurs”, that can make a real difference for many people and also have a major social impact.

Fintech is creating new and exciting applications as well as impacting traditional finance. Blockchain in particular is seen as the disruptive technology for traditional finance. What trends do you see in traditional finance, digital banking and new tech?

I believe that new tech could learn a lot from traditional finance, especially in terms of personal finances. I think the “be your own bank”-phrase has been used too much – for a lot of people loans and mortgages are a necessity. And it’s great to “hold your own keys”, but many are probably better off, if a bank-like institution holds it for them, maybe even with added insurance.

But I think the experience with banks and digital banking is very different, depending on where you live. Where I am from, all citizens have 2 factor authentication for things like social- and banking services. In other places, a SIM swap may be enough to hack a bank account.

I think new technology will create larger awareness of cyber security, both from the lessons learned from “holding your own keys” or using 2FA to secure and access your money with a custodian.

There is also talk about social and environmental factors of finance. Some examples are the heavy energy consumption of proof-of-work and the coronavirus.

What changes do you see taking place due to societal and environmental changes when it comes to money?

I think the world is right to consider what kind of environmental cost they are willing to pay, to secure their financial systems. As for social impact, the transparency of (most) blockchain technology makes it an ideal means to transfer value and document to donors where money is going and how it is spent.

Find out more about Thomas’ history with blockchain, cryptocurrency and the XRPL in part 2 of our interview.

We talk about his first experiences with the technology and his early projects. Then we take a deeper dive into XRPL, a topic well known to Thomas. Tune in this Thursday to find out more.