You probably know that GateHub first started offering XRPL wallets as early as in 2014. We have been offering services on and off the XRPL since then and the XRPL wallets have been a key component of our story.

We want to show off some of the things the XRP Ledger can do. In our next installment we will talk about XRPL wallets on GateHub and how we have been making them better since our inception.

The public XRP Ledger

XRP is the native currency of the XRP Ledger formerly also known as the Ripple Ledger or Ripple Consensus Ledger (RCL).

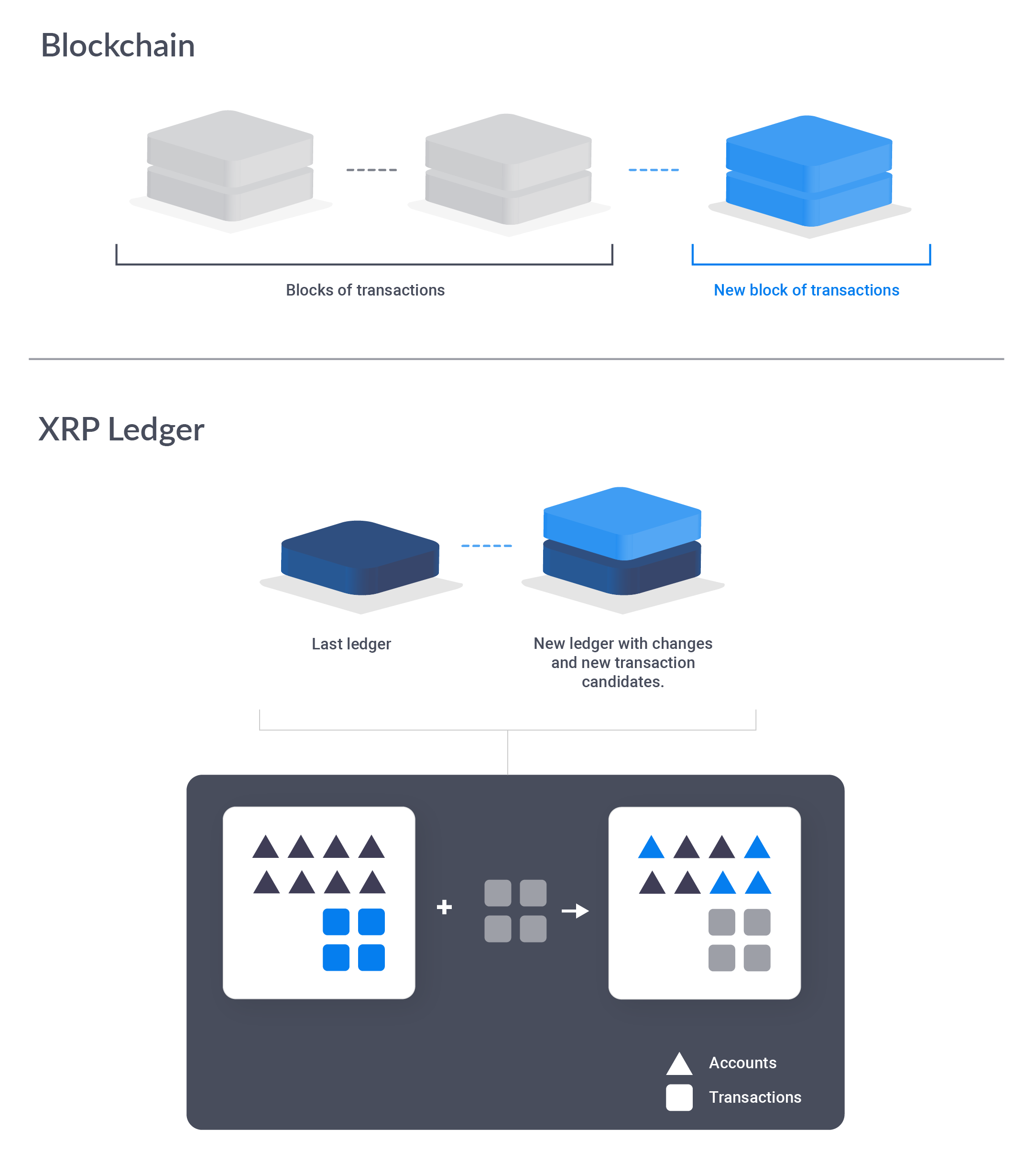

The key difference between the XRPL and blockchain based networks is how the software confirms and adds transactions to the global history of the network.

In blockchains, blocks of transactions are added to the end of this history. To know the full state of the network you need to piece it together from the full history of blocks.

On the XRPL the full state of the Ledger is written in the last ledger. A ledger acts similar to a block on blockchains. It contains the current state of all the accounts and all the transactions to be executed in this iteration. The next ledger then contains all the agreed upon changes from the previous ledger and accepts new transaction candidates.

Blocks of various blockchains require mining to resolve computational challenges for a reward. On the XRPL, validation nodes act as trusted parties to confirm new transactions.

The base entity of the XRPL is an address, also known as Ripple address and more recently XRPL address. At GateHub we call them XRPL wallets. It is composed of a public address (starting with “r”) that is used to receive funds and can be shared freely, and a secret key (starting with “s”) that is used to authenticate transactions and must be kept safe.

Transaction cost and reserves

Some transaction costs are present on blockchain and the XRPL. On blockchains a mining fee is required to be paid for a transaction. This goes to the miners who are cracking the computational problem of the next block. The XRPL introduced a transaction cost that burns a small fraction of XRP for each transaction. Most often this is 0.000015 XRP (or 15 drops) but can increase when the network is under extraordinary load or for certain types of transactions (such as escrows).

There is another mechanism to prevent spamming the network that is unique to the XRPL. It’s called a Reserves. This feature requires each active account to hold at least 20 XRP that are not redeemable. For every item owned on the Ledger another 5 XRP of reserve is required. These items are, for example, trust lines and open orders.

Issued currencies

The XRPL has a special feature that allows any account to issue a currency. A gateway can be a service that issues currencies other than XRP on the XRPL to allow for cheap sending and exchanging of the issued currency. This is what GateHub is doing with GateHub and GateHub 5th gateways.

The purpose of this is to reduce the cost and delay of sending and receiving certain currencies over their native networks. For example a bank transfer can take from a day to several days, while transferring funds over the XRPL takes about 3 seconds. Same goes for cryptocurrencies that mine blocks at regular intervals (i.e. Bitcoin’s 10min/block).

Issued currencies require a “trust line” to be set between the issuing address and the address that wants to use this currency.

Exchange and pathfinding

Another cool feature of the XRPL is its built in decentralized exchange. XRP and any issued currency can be exchanged to any other issued currency on the ledger. An address can post a market order with the bid/ask price and a market is established.

This enables two more functions.

Instant exchange where existing market orders can be used to fulfill a so called fill-or-kill order. It either executes in full if there is enough liquidity or is canceled.

The other is pathfinding which uses existing markets to spend one currency on the sending side and deliver another on the receiving side.You can, for example, spend GateHub’s USD to deliver XRP to somebody who can only receive XRP.

Advanced features of the XRPL

As we mentioned above, a XRPL address, by default, has a unique secret key (also called Master key). This key is used, again by default, to sign any new transaction on the Ledger. A master key can be disabled, and another address’ secret key can take its place. This key takes the role of signing new transactions and is called a Regular key.

One address can have multiple keys that can sign its transactions. These keys can be weighted and a certain number of them can be required. We call this multi-signing and can be used when the funds on an address are owned by multiple entities and need multiple parties to confirm a transaction.

The last feature we want to talk about is the Escrow which can serve as an independent party that holds the funds until a certain condition is met. This ledger entity is completely unbiased and will execute or return the funds to the originator if the condition is not met.

XRPL wallets

At GateHub, we offer XRPL wallets that can do most of the things described above. We will talk about our XRPL wallet features in the next blog.

Want to see everything you can do on the XRP Ledger yourself?

Try it out!If you don’t want to miss any of our updates follow us on Facebook and Twitter.