Almost everyone has heard of cryptocurrency by now, but not everyone knows exactly what it is and how it works. At GateHub, we wish to raise awareness and improve the public knowledge about cryptocurrencies. That is why, in the next couple of weeks, we will discover the world of cryptocurrencies, blockchain, distributed ledger technology and more.

What is cryptocurrency?

A cryptocurrency is a digital asset that can be used as a medium of exchange and is stored in a digital ledger or computerized database. The transactions are secured with cryptography, hence the name cryptocurrency. They are typically not issued or controlled by a central authority.

The conditions to qualify as a cryptocurrency system boil down to this:

- there is no central authority,

- the process of minting new coins is formalized and defined in advance,

- ownership of coins is public and can be proven cryptographically,

- ownership of coins can change and

- only one change of ownership can happen in one iteration (block).

Some centrally controlled cryptocurrency systems do exist but these are not in the scope of this blog.

The first decentralized cryptocurrency, Bitcoin, was released as open-source software in 2009. Since then, over 6,000 altcoins have been created.

How cryptocurrencies came to be?

The need to make money move faster and more transparently had been around for a while even before the advent of the internet. Check out our FinTech article to learn more.

Before the creation of cryptocurrencies as we know them today, many have attempted to create a digital currency during the internet tech boom in the 90s.

Some examples are David Chaums anonymous cryptographic electronic money called ecash in 1983 which was later realized as Digicash. Then there is Wei Dai’s 1998 description of "b-money", characterized as an anonymous, distributed electronic cash system that used some of the concepts later seen in Bitcoin like proof-of-work.

Others such as Flooz and Beenz emerged in the late 90s and early 00s just to fail as the security and vulnerability to fraud aspects had not been anticipated by the creators.

Later on, in early 2009, an anonymous programmer or a group of programmers going by the alias Satoshi Nakamoto, introduced Bitcoin. It was described as a ‘peer-to-peer electronic cash system’ (History of Bitcoin). This marks the start of cryptocurrencies we know today.

What kinds of cryptocurrencies do we know?

We have mentioned before that there are around 6000 different altcoins that came after Bitcoin. The term Altcoin usually signifies any cryptocurrency other than Bitcoin. Some have become almost as popular as Bitcoin and others were created only to fail quickly.

Some websites like CoinMarketCap specialize in providing the data about as many cryptocurrencies as possible. We have already described what altcoin means, but there is another division between cryptocurrencies. Some are called coins and others are called tokens.

Coins usually exist on their own blockchain. In general coins are those cryptocurrencies that can act as a medium of exchange and therefore behave similar to actual money. This means that they can be used to transfer money (give and receive value), as a store value (saved for later and swapped) or as a unit of account (other things can be valued in terms of a coin).

Tokens on the other hand serve a more specific purpose, but since tokens can appreciate and depreciate in value, the line can seem blurry. In general, tokens serve a more specific purpose and usually have one central utility. We differentiate between four types of tokens at the moment, although a token can fall into more than one category:

- Security tokens act as investments with the expectation of profit. These were mainly created by ICOs.

- Equity tokens can represent stocks or equity but there is still regulatory uncertainty about these tokens.

- Utility tokens are used to provide a certain benefit in an application like unlocked features or discounted trading fees.

- Payment tokens are used to pay for goods and services often on a specific platform or app.

You can read more about the difference between coins and tokens in this exhaustive blog.

How to get cryptocurrency?

The most popular option is to send your FIAT money (USD or EUR) to a trusted exchange and then trade your money to any of the supported currencies. BTC is still the most easily accessible coin with almost 1,800 Bitcoin ATMs in 58 countries. You can also buy Bitcoin and some other cryptocurrencies by using gift cards, investment trusts and in some cases even trade face-to-face.

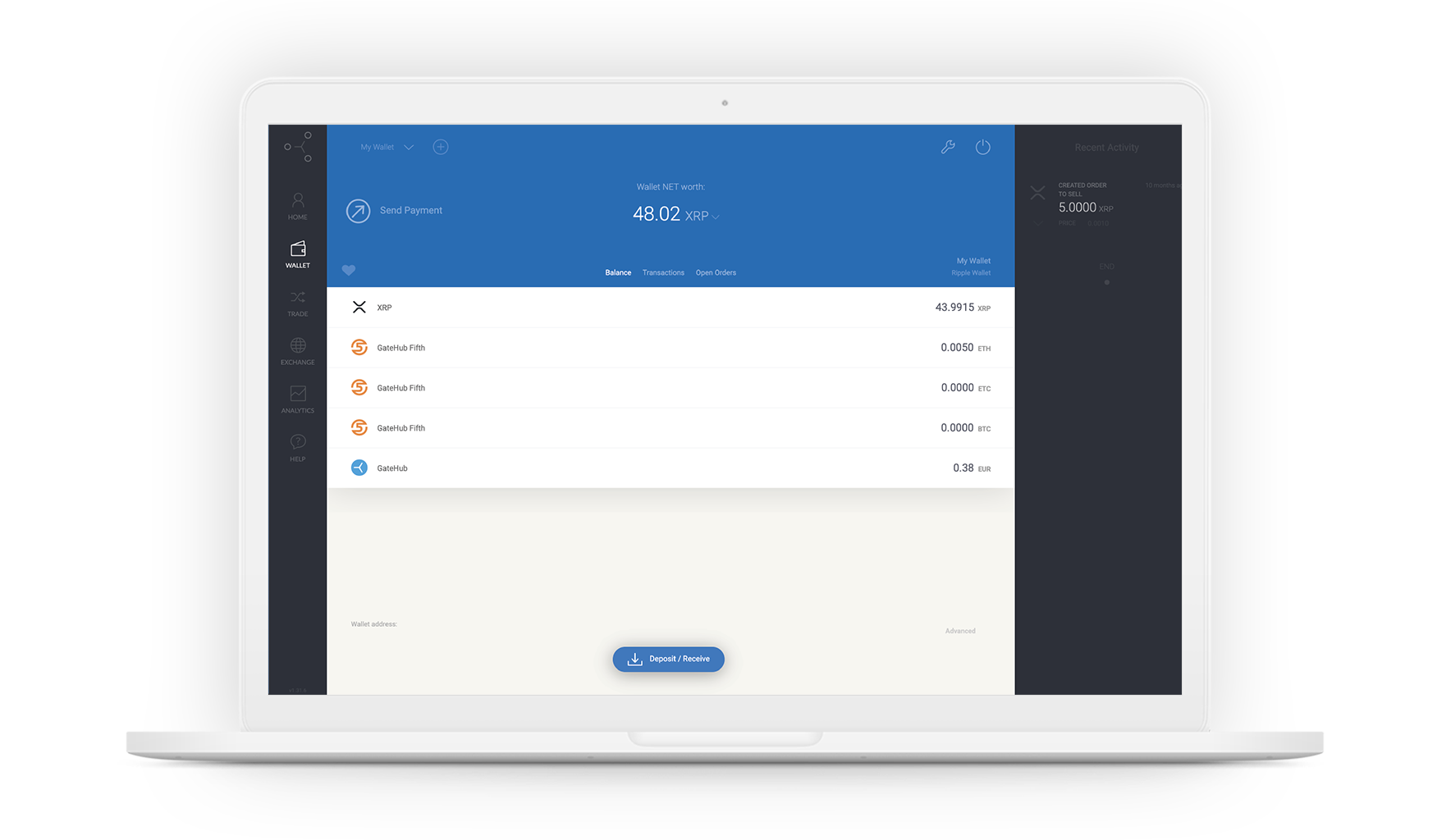

Some cryptocurrencies, especially the less popular ones, can sometimes be harder to buy. There are some exchanges that specialize in tokens and some currencies are only listed on one specific exchange. At GateHub, you can buy XRP, BTC, ETH and a few other cryptocurrencies with EUR and USD.

Storing cryptocurrencies requires a completely different approach than storing physical money. In fact you do not really store your units of cryptocurrency, but rather, the private key that you use to cryptographically sign transactions. These keys must be stored very securely.

A cryptocurrency wallet is a device, application or a service which stores and encrypts the public and/or private keys and can be used to track ownership, receive or spend cryptocurrencies.

Finding the right fit for your needs can be difficult as there are many different cryptocurrency wallets. They can be online, local, offline/paper or hardware based. They can also offer to store your private keys in different ways or offer a multisign service

Sign up for GateHub

At GateHub, you can use a public XRP Ledger Wallet where you own the private key, or opt for a Hosted Wallet that is stored on a non-public ledger operated by GateHub.

Get Started!

Cryptocurrency use cases

Cryptocurrencies have a few popular use cases which have already become mainstream. Some businesses on the other hand are exploring new use cases that are not yet commercially viable. We will focus on the first group of use cases here.

Investing

The high risk - high reward potential makes cryptocurrency a popular investment today. We saw its overnight success back in 2017 and 2018, where many became rich and many lost a lot of money. The market has stabilized since then and is showing steady growth. Most exchanges allow you to trade the top 3-5 currencies and some specialize in supporting as many coins and tokens as possible.

Regulators have entered the field which will make likelihood of ICO and other scams that helped inflate the 2018 bubble much lower. Businesses are also seeing the value of transparent and long-term development in this industry that shows great promise.

As with any other investment, research and an understanding of the market is vital to avoid losses and minimize the risk. Before making an investment, you should check your local regulations, legislation and tax obligations regarding investing in cryptocurrency to avoid breaking any laws.

Mining

As a form of investment, you can also decide to mine some cryptocurrencies. The most obvious choice seems to be Bitcoin, but there are many others like Ethereum, Litecoin, Zcash and others.

A computer’s CPU or GPU computing power is used to solve complicated cryptographic puzzles. These need to be solved in order to “mine” a new block on the blockchain which means that the pending transactions are completed on the blockchain.

Miners can make a profit by receiving a reward as well as the transaction fee once they solve these cryptographic puzzles. For Bitcoin the initial block reward was 50 BTC. Every 4 years this reward was halved and just this week the reward to mine a Bitcoin block was decreased to 6.25BTC per block.

Buying goods

Not too long ago using cryptocurrency as payment sounded impossible. Not anymore as many retailers from around the world now accept Bitcoin and even other cryptocurrencies as payment.

Although Bitcoin is still the most accepted digital currency, others such as Litecoin, Ripple, Ethereum are making their way into payments. We are nearing 10 years since the Bitcoin pizza event which started it all in a way.

The future of cryptocurrency

More and more legitimate businesses and startups are offering their services revolving around cryptocurrency. Since the entry of cryptocurrencies into the mass media and the social consciousness, FinTech businesses have developed new ways of harnessing the power of blockchain and cryptocurrency.

The upside to this is that banks are pushing more powerful, cheaper and more convenient online products to keep in stride with the more agile FinTech businesses.

At the same time, FinTechs are working on improving the existing money rails and building the future of payments, while cryptocurrency and blockchain focused businesses are coming up with new use cases for the technology to make our lives even easier and push the boundaries of what seems possible.

The attention that blockchain and cryptocurrency related businesses have been receiving lately from regulators is also a good sign of a maturing industry that can operate in safer and more transparent ways.

As cryptocurrencies became more popular, law enforcement, tax authorities and legal regulators had to adapt and fit them into the existing regulations and legal frameworks. Today each jurisdiction might have its own specific set of rules on dealing with cryptocurrencies and one has to be familiar with it before diving in. We have summed up some of these new regulations here.

The industry is evolving and every day we see exciting advances. What do you think? Are cryptocurrencies here to stay and make the world a better place?

The industry is evolving and every day we see exciting advances. What do you think? Are cryptocurrencies here to stay and make the world a better place?