This article is intended for complete newcomers to the cryptocurrency space so most concepts will be simplified for brevity and accessibility. We included links in the text that expand on the topics in question.

What is cryptocurrency?

Cryptocurrency or crypto for short is a digital medium of exchange that is secured by cryptography, hence the “crypto” in its name. Bitcoin is the most popular cryptocurrency but there are many, many others that serve different purposes. There are services called aggregators that list currencies by certain criteria like CoinGecko and LiveCoinWatch.

There are tons of websites that explain cryptocurrencies and the main things to know about them.

What is blockchain?

Blockchain is a term that is used for a sequence of “blocks” that contain transactions. Every block makes changes to the state of the network and the full “chain” constitutes the history of the network. Blockchain is technology that enables the existence of cryptocurrencies. It uses cryptography and programmatic rules to sustain the network.

How does cryptocurrency work?

The gist of all the types of blockchain and its derivatives is that there is no central authority in control of the accounts and transactions on a network. A bank has full control over your bank account and any transaction you want to make while nobody has any control over your cryptocurrency address and transactions on a network.

Most newcomers to crypto will create an account on a centralized exchange so it needs to be stressed that using an exchange does not necessarily mean you will get to interact directly with a blockchain, rather give instructions to your exchange on what to do with your money.

But again..how does it work?

Blockchain technology requires that certain participants confirm transactions in a decentralized and trustless way. The technology counts on a mass of participants that do not know each other to behave in a proper way in order to confirm transactions in the correct order to avoid the double spend problem. These participants are called miners (in proof-of-work), forgers (in proof-of-stake) and validators (in distributed ledger systems).

What is Bitcoin, Ethereum, XRP…?

All of these are cryptocurrencies but they serve different purposes and work in particular ways. There are ways to distinguish cryptocurrencies by type if you look at their utility. One way is to differentiate between coins and tokens. Coins usually reside on their own blockchain and can be used as a medium of exchange while tokens can have specific utilities. All coins and tokens have a value and most can be traded among each other and with fiat money like USD and EUR.

What is all this proof-of-work and proof-of-stake stuff?

These are just ways in which transactions are validated on the network. In proof-of-work (PoW), the process is called mining and, essentially, miners need to spend a non-trivial amount of computing power to come up with a solution to a cryptographic puzzle. The first one to come up with the solution gets the “block reward” in the form of new coins (or transaction fees). In proof of stake (PoS) the participant that will confirm the next block is selected algorithmically from a group of coin holders and rewarded in the same manner.

What do I do with crypto?

There are a lot of uses for crypto. For newcomers, the most obvious use is to buy crypto, wait for its value to appreciate and then sell for a profit. This strategy is called holding, or long (in crypto slang also “hodl”). There are numerous other options in the cryptocurrency space. Staking crypto is an easy way to add value to your portfolio. A similar type of venture is yield farming where users can lend crypto in return for a percentage of the lended amount. Mining has a high barrier to entry but is also a viable option for some. Advanced trading options also exist but they are not available yet on the XRPL DEX.

The technology gains traction every time the value of cryptocurrencies appreciates. As an investment it offers low barriers for entry and relatively high profits at similarly high risk. It is possible to invest with very small amounts of money. A 100% appreciation or a 50% drop are not rare occurrences in crypto so keep that in mind.

Over time we expect the prices to stabilize and actual adoption is going to drive value instead of speculation. We are still saying we’re early into the tech so it’s probably safe to assume there are profits to be had from investing.

Cool! How do I invest?

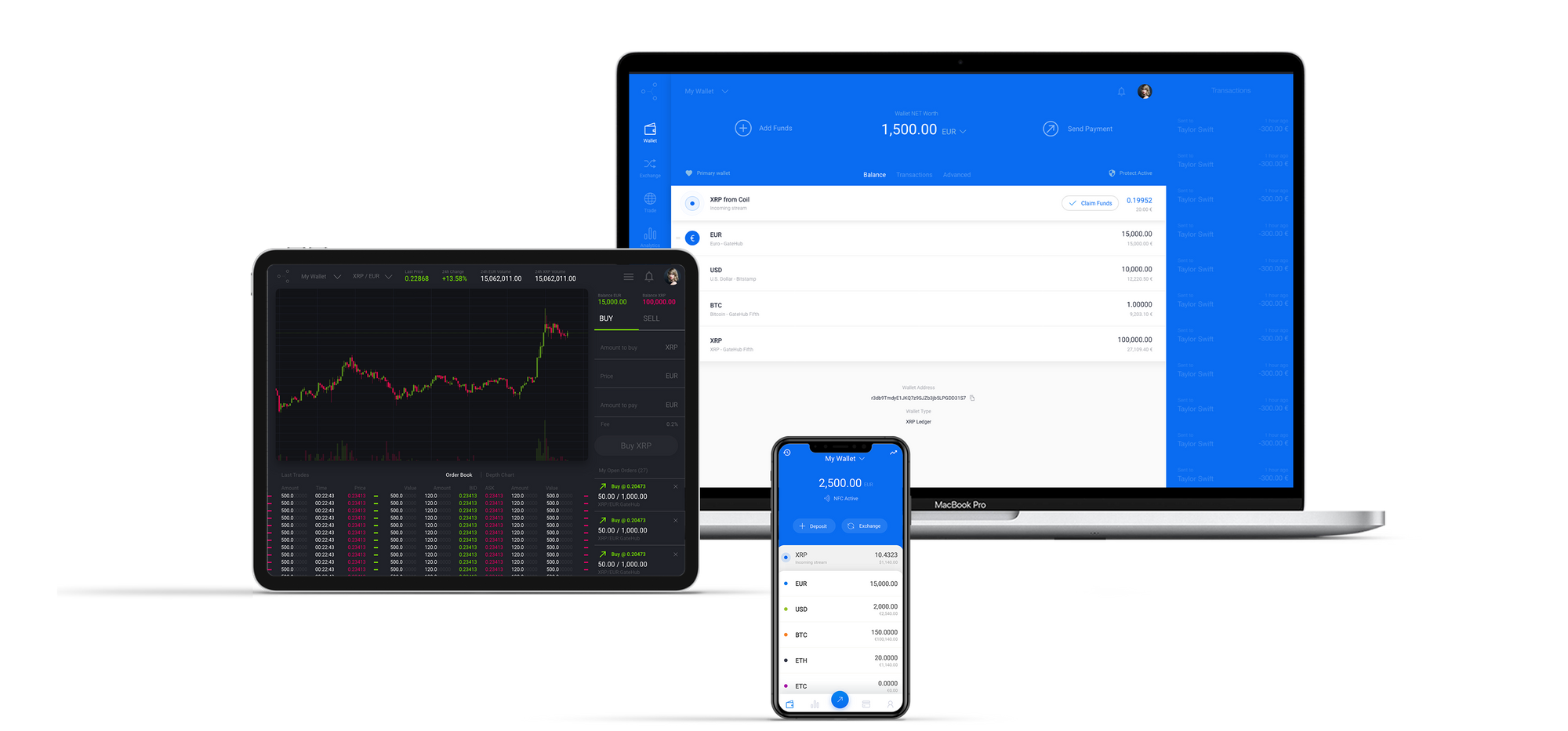

Your best bet is to create an account with a cryptocurrency exchange. You will most likely need to verify your identity and then top up your account with fiat money like US Dollar or Euro. Most modern exchanges like GateHub are very easy to use.

Is it safe to invest in crypto?

Security is often top of the list for newcomers.

We really can’t stress enough that users can do the most about their security on exchanges and more broadly on the internet itself.

Here’s a checklist of what you can do to protect yourself:

- Secure your email(s) to reduce the risk of password resets and set up your inbox to block as many spam messages as possible.

- Use a password manager that will let you generate secure and unique passwords for each website.

- Use reputable online services and share your data responsibly. Browsing responsibly also helps to mitigate some threats.

- Use reputable exchanges and check their policies on the protection of your personal data and money.

- Use 2-factor authentication wherever possible.

In general, it’s safe to invest in crypto as services have improved massively from the inception of exchange services some 6 or 7 years ago.

As an investment, cryptocurrency is a high risk investment so only invest money you can afford to lose.