In our first blog about Decentralized Finance (DeFi), we provided a short overview of what it is and presented some of the platforms that facilitate it.

It is important to point out that DeFi platforms have been around for quite a while, but have only seen an increase in media attention in recent months. Why are they generating so much media and investment interest right now?

In this blog, we will present why DeFi platforms are gaining popularity and how traders/investors are able to make money with it.

Disclaimer: This post is for informational purposes only and should not be viewed as investment advice.

Why are DeFi platforms gaining popularity?

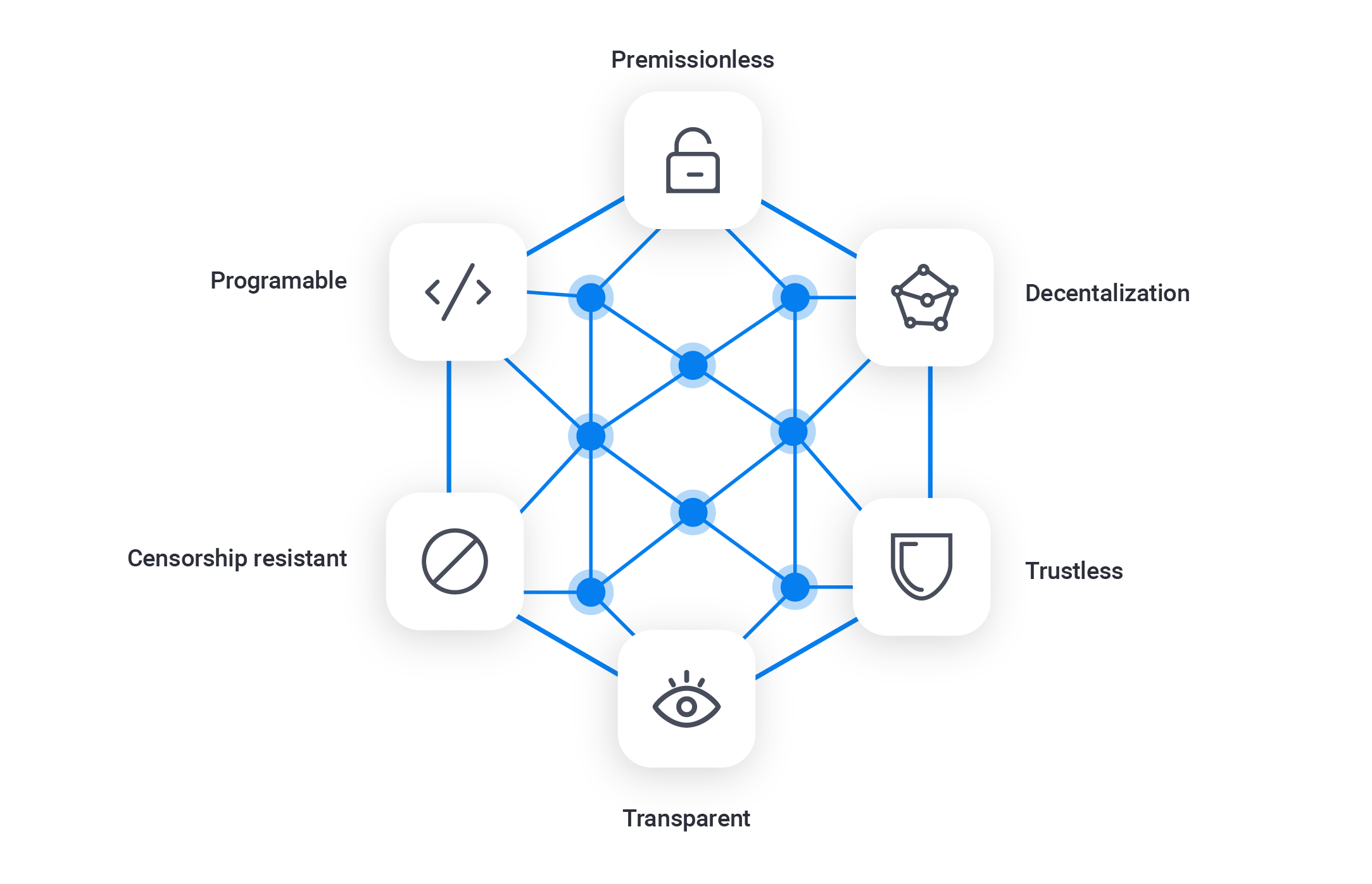

One of the reasons why many investors and traders are turning to DeFi platforms is because of their principal characteristic - decentralization. Decentralized exchanges have been experiencing a significant increase in trading volume in the past few years. This is mainly due to technology advancements, increasing ease-of-use and no KYC requirements.

However, the reasons mentioned above are of course not enough to generate the hype we are experiencing right now. The main reasons are that some of the newest DeFi platforms have introduced a few investor friendly features recently. Namely, liquidity pools and incentive tokens which have soared in value.

How does it work?

A focal characteristic of DeFi platforms is that they do not offer an order book. Instead, users can seamlessly swap one token for another at a price that is given in advance.

But who is on the other side of this trade?

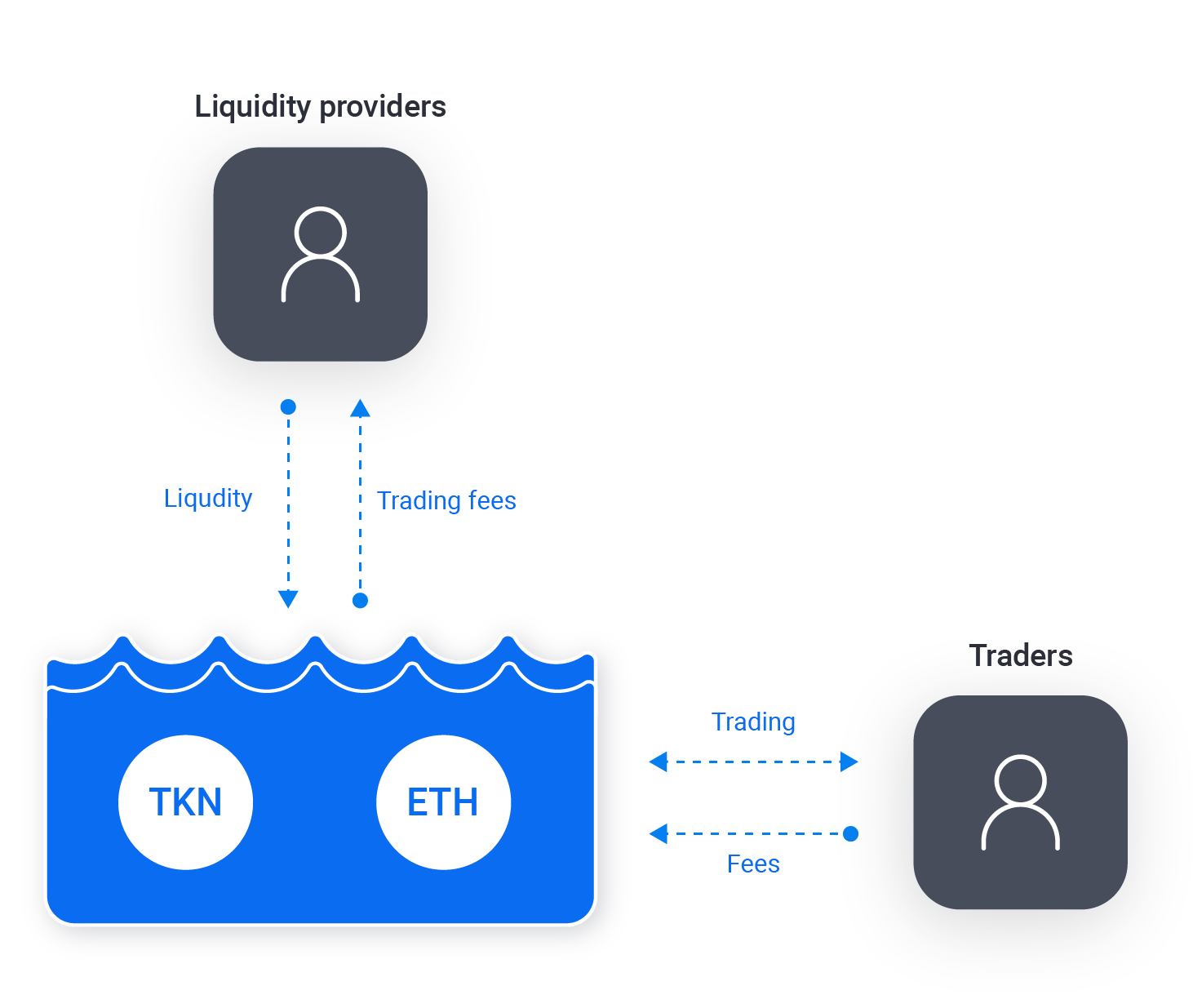

The answer is liquidity pool providers and the price that is given is determined by an Automated Market Maker (AMM), which consists of smart contracts that operate with liquidity pools and traders can trade against.

Liquidity pool providers deposit their funds in a liquidity pool and their funds are then used for trades on the platform. In exchange for providing liquidity they earn trading fees proportional to their share of the liquidity pool and incentive ERC-20 tokens which represent their share of the total liquidity pool.

This type of lending in exchange for a portion of the trading fee is commonly known as yield farming. The incentive tokens have some very interesting qualities regarding their supply and emission and as mentioned in the previous paragraph are most likely the main reason behind the 2020 DeFi hype.

Tokenomics

Most DeFi products are built on the Ethereum network and due to this, the incentive tokens they distribute are ERC-20. Each project is built differently and each DeFi token offers different advantages.

The distribution of these tokens is carried out by smart contracts and most can be earned by either trading, providing liquidity, staking or lending. Once you own these tokens, they guarantee you some rights, usually in the form of governance of the entire protocol. Token holders can be involved in proposal submissions and voting on important decisions regarding the protocol and tokenomics.

Another interesting characteristic of these tokens is elastic supply. Each new token emission can be different from the previous one and this is due to the fact that each distribution is adjusted according to market conditions, mostly mirroring the fluctuation of total value locked in the entire protocol.

An important thing to mention here is that most of the DeFi projects have issued public statements that the incentive tokens do not hold any inherent value. Nonetheless, most of the prices of these tokens have skyrocketed in recent months.

Risks

As with any new product, there are of course some risks that every potential investor should consider before attempting to participate in the DeFi hype.

Defi platforms basically run on numerous smart contracts that interact with each other. A general rule is to only trust platforms that have had their smart contract audited. We advise you not to participate in fun “hobby” projects that are popping up and promote enormous quick profits.

DeFi, like cryptocurrencies is without a doubt a risky investment. The general rule is to only invest as much as you can afford to lose and do your own research before investing.

The crypto and DeFi space offers a lot of opportunities for financial gain, however the downside is that the space is also brutally competitive and unforgiving. Investing should be done with great care.

Closing thoughts

The DeFi space is looking lively and seems to have sparked new interest in the world of cryptocurrency too. The entire crypto space has matured a lot in the past few years, but DeFi is still in its infancy phase. We stress again that investing in cryptocurrency and decentralized finance is still extremely risky.

A conservative and risk averse approach would be to give it a try with small amounts and learn the ropes first before diving in with any significant value. The future looks exciting and bright so make sure you are ready for it.