Here is our second part of our talk with Thomas Silkjær, founder and CEO of xrplorer. Thomas shed some light on his personal experience with fintech and his visions of the future of finance in part 1 of our interview. In the second part, we explore blockchain and cryptocurrency and talk about the XRPL.

We all know your focus is on XRP but what about other cryptos and blockchain in general.

When and how did you first learn about cryptocurrency in general? What did you think about the technology back then? What was your first project on blockchain?

I remember working with freelance graphic design back around 2009-10 and a client asked me if I wanted my payment in Bitcoin or on PayPal. I also remember installing some Bitcoin software around the same time, just out of curiosity.

It would’ve been a great story to share that I later found my “forgotten fortune”, but I did receive my payment on PayPal, and I never mined anything. Honestly, back then I had no idea how much impact blockchain would have on the future of finance.

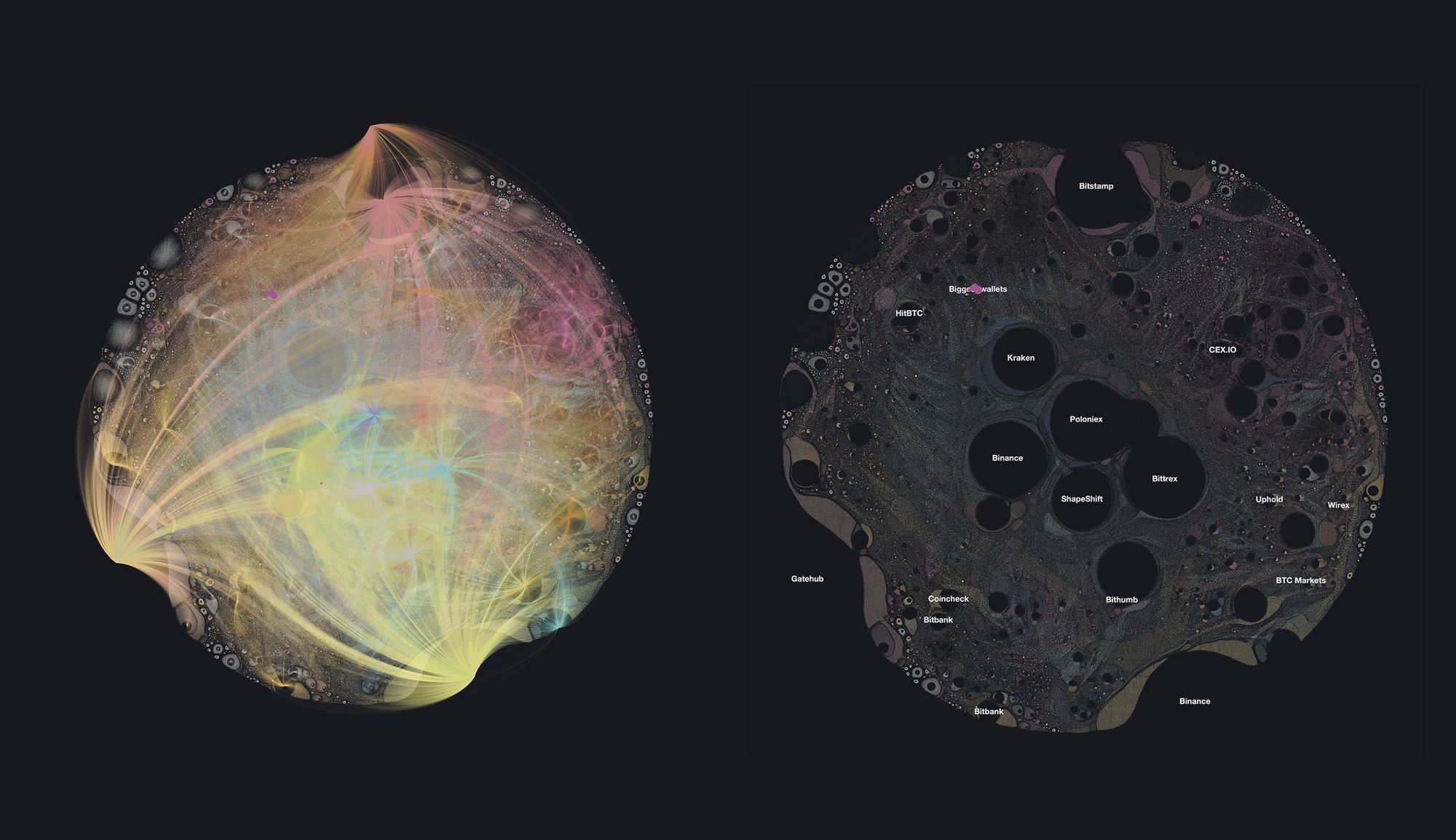

My first blockchain projects were the visualizations and statistics I extracted from the XRPL, and published on the XRP community blog. I was using the public XRPL APIs and later a Google BigQuery dataset, Wietse Wind had established.

There are strong philosophical, technical and even political implications to the idea of decentralized and trustless financial systems. The financial landscape has changed significantly in the last 10 years, not only due to blockchain, but also regarding digitalization and identity technologies. What is your vision of the future for fintech?

I think blockchain has proven its potential, but we have only seen the beginning of the impact. I am not a “global currency believer”, I don’t believe that FIATs will be replaced by a non-governed trustless token any time soon – if ever. So in my opinion, the USD will not be replaced by BTC or any other digital asset any time soon. However, the technology is already being adopted, and I see no way around blockchain as a central element in the future of finance, such as CBDCs.

My, probably unpopular belief, is that digital assets (CBDCs excluded) will not be mainstream for many years. But everyone will be using the technology. Payment systems, cross-border payments, digital banking, voting, parcel tracking, you name it, will appear “as usual”, while blockchain technology is used underneath. And new innovation will happen, such as web monetization or similar things that was never possible before.

Innovation has to happen in the same phase as the majority of people can grasp it. I don’t believe the world is yet ready to “being your own bank” and “holding your own keys”, but the near future will accommodate both the traditionalists and the first movers, and they will be using the same technology whether they are aware of it or not.

Regulations seem to hold back the idea of permissionless, trustless and anonymous transaction systems. Securing digital assets seems to be one of the focal points of development in fintech and blockchain. Fraud and fraud prevention systems are getting more sophisticated. What is your take on fraud and fighting fraud in the industry?

I think that blockchains have to be somewhat auditable to function in a regulated world. In short: I don’t believe there is room for privacy coins with private, untraceable transactions. That doesn’t mean that privacy is impossible, but only that regulated providers can offer gateway functionality to forward payments, to make it difficult, if not impossible, for anyone to trace it.

That is basically the setup today, where you can move XRP to any VASP and withdraw it somewhere else. Even though the blockchain is public, the transactions will be lost in the crowd. But it is auditable by authorities in cases of foul play, if the VASP is regulated and has proper KYC/AML systems in place.

On paper it is very simple: public blockchains are much easier to trace and with regulations and KYC/AML, it should be possible to easily follow the money and stop all sorts of financial crimes. But the reality is different, as the space is also crowded by irresponsible VASPs, lack of regulations, and VASPs hiding behind several companies to cause jurisdictional confusion and avoid regulations altogether. It requires a huge effort from the regulatory bodies to clean it up!

And then comes the second challenge, it is creating several “economies”: the regulated economy where it’s easy to participate and get FIAT in and out. And the dark economy where criminal over-the-counter trading desks and gateway services are providing similar.

And this not to speak of the challenges with phase of development, decentralized DeFi currency swapping, and the countless number of digital assets available with lack of proper tools to monitor and trace payments.

In short: fighting fraud and preventing criminal finances is easier on blockchain than traditional FIAT, but it will at least require regulations, stricter regulatory enforcement, private/public sector collaboration to keep up with innovation, and development of tools and technology to discover and trace payments.

Ripple and the XRPL have been running since 2012 and 2013 respectively and they both have an interesting prehistory. Your 2019 article is a great intro to XRP, XRPL and Ripple for anyone. There are so many projects and ways of making a living with cryptocurrency that there must be a special reason why XRPL. When/how did you first learn about Ripple, XRP and the XRPL?

When and why did you decide to work on the XRPL?

When cryptocurrencies first got my attention, I was looking at various investment opportunities, XRP being one of them. But I never made an actual decision like, “I want to work with the XRPL – let me find a niche or gap in the market and develop a product that fits there”. It was rather a curiosity that let me learn the APIs and how everything worked, and compared to many other blockchains, many XRPL concepts are quite easy to grasp – mainly because you never have to learn the concepts of things like UTXO, PoW, PoS, and EVM.

Moving forward from this, it seems you evolved your work to XRP Forensics and then to xrplorer (how do you pronounce this?). You are styling yourself Founder and CEO of xrplorer so it seems like this is your main occupation. How did the idea for XRP Forensics and later xrplorer come about?

Haha, I just call it “explorer”. Fortunately most communication is written, so I won't have to explain the spelling.

In early 2019 I saw some YouTube videos promoting fake airdrops and giveaways, and heard stories from Twitter users of losing their XRP to these scams. Given my interest in digging deeper into transactions, from doing graph visualizations and ledger statistics on the XRP community blog, I started looking into how it would be possible to trace these scams or maybe even prevent it from happening. Along the way I had to invent new ways to query the data, as the XRPL APIs were not enough, and the first generation graph database representation of the XRP ledger was born, making it possible to do advanced graph queries of transaction flows.

What became XRP Forensics started as a group of enthusiasts that each contributed with different things in an attempt to educate, prevent and counter financial crimes and scams on the XRPL. Over time the project became xrplorer and the graph database representation grew from a representation of payments, to a full representation of all kinds of transactions: making it possible to do what we do today.

Ripple seems to be taking steps towards open-source standards. What is your take on the Xpring initiative and PayID to mention a few?

Onboarding new developers to the XRPL ecosystem is crucial to secure the network, and create a healthy economy. So education and tools, such as SDKs and APIs, are more than welcome, and will make it much easier for new developers to build on the XRPL. That the XRPL itself is open-source is first of all a necessity for a decentralized ledger, but also for the continued development of the core technology – everyone can fork the code and use it to make new networks (such as Stellar or Casino Coin), but also extend the XRPL by introducing new amendments.

Flare has recently announced their plans for launching a new standalone network but with strong ties to the XRPL. Their token (Spark) will be distributed to XRP holders and a consensus algorithm is used as a way of confirming transactions. What is your take on the recently announced Flare “fork” on the XRPL, Spark and their DeFi use cases?

Unlike e.g. Ethereum, there is no core/native support for smart contracts on the XRPL – except for the “predefined” use cases, such as escrows. To my knowledge there are 3 public projects addressing this, in three completely different ways.

Flare is solving the issue by creating a new blockchain with ways to trustlessly swap XRP for a XRP token. It’s a very interesting concept and I am excited to see how well the concept plays out!

Codius is another solution, but given that it is not a “layer one”-solution, it will likely not solve the same problems that Flare can.

Thirdly is Hooks, an amendment for the core XRPL suggested and in development by XRPL Labs, that is best described as “smart contracts light edition”. It will bring smart contract capabilities to the XRPL itself, but maybe better described as a “if this then that”-system on the blockchain, than a full blown virtual machine like EVM.

What are your thoughts on other hot topics like centralized digital currencies and DeFi for instance?

I think I have covered much of this in the earlier questions, but it’s very interesting to follow the innovation – but it is a bit ironic that while many people wish for blockchain and digital assets to really go mainstream, it is evolving so quickly that it’s likely difficult to grasp for even most blockchain proponents. The technology and terminology is constantly evolving – from mining to farming.

What do you see yourself doing in this industry in a few years? Ideal scenario.

I hope xrplorer is still around :)

We do too, Thomas!

For anyone interested in finding out more about Thomas and his work, make sure to check out his contributions on Forbes and the notorious XRPL visualizations piece from 2018 which still makes for an intriguing read.

Make sure to also check out xrplorer which is packed to the brim with cool features and analytic tools for the XRPL.