One of the obvious trends is that big firms are increasing their investments in FinTech organizations. This can be explained by the growing need for financial service institutions to increase cost-effectiveness, service portfolio, and customer experience. Technology and innovation play a key role in making progress within these identified areas. Smaller, more agile firms have been able to tackle the hurdles experienced by financial service institutions and package the solution into very enticing value propositions.

In 2018, FinTech supplied the market with nearly 1,300 deals in North America and Europe alone, worth over US$15 billion, consistent with knowledge from Pitchbook. At the same time, KPMG estimates that over US$52 billion in investment was poured into FinTech initiatives globally in 2018.

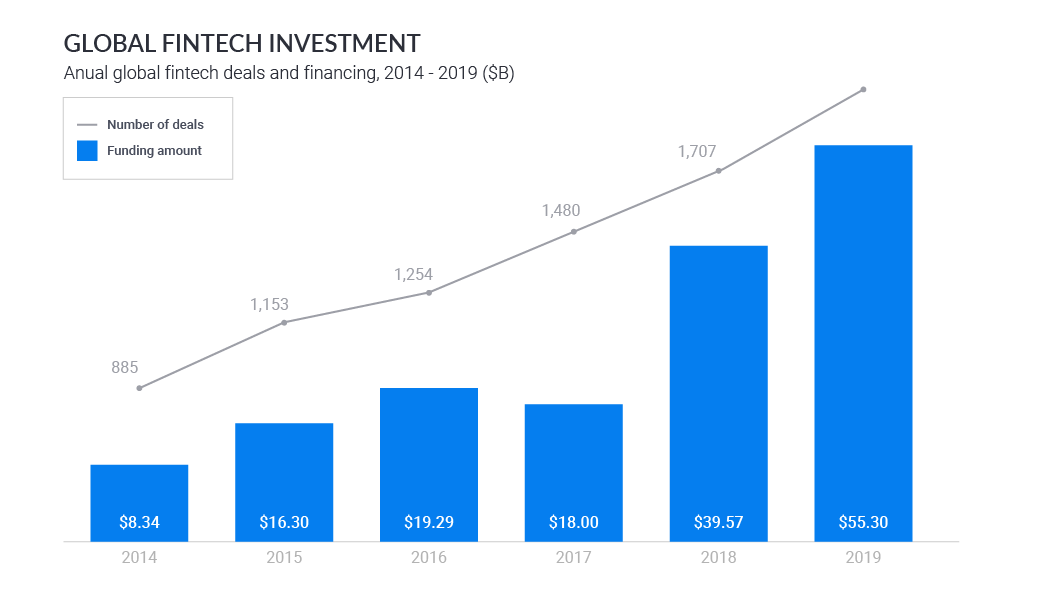

The startup community observed a high number of hundred-million-dollar FinTech capital raises just last summer. FinTech reached US$55.3 billion in investments in 2019. To this figure, China contributed a total of US$25.5 billion, of which more than half (US$14 billion) is from Ant Financial of Alibaba Group, known for its Alipay mobile payment service.

Investors are seemingly “banking” on some huge profits. Corporations targeting FinTech, banking and mobile payments in North and South America brought in US$11.7 billion in 2019, as per Crunchbase, up from US$9.2 billion in 2018.l

2019 appears to be the year that each startup decided to become a bank and each speculator (venture capitalist) decided to write a check to at least 1 of these startups. It wasn’t simply a few large investments either. Funding in 2019 was spread across 700+ identified startup funding rounds.

Much of the funding went to “neobanks,” an elaborate term to explain upstart digital banks acting on everything from savings and checking accounts to mobile debit cards. Several of these neobanks are bringing banking services to customers and businesses that have previously been under-served by traditional banks.

Still, super-giant funding rounds did help boost the totals. Among the highest profile upstart banking brands, Chime pulled in an astonishing US$700 million across 2 mega-rounds this year, pushing its valuation to US$5.8 billion. Brazil’s Nubank, not to be outdone, raised a hefty US$400 million during a single July round.

As mentioned, FinTech reached US$55.3 billion in investments in 2019. The 5-year year-over-year growth is illustrated in the image below. How much investment do you think FinTech will see in 2020? At this rate, the numbers can be sky-high.

All figures in this article are expressed in US dollars unless otherwise noted.