The software that enables payments and credit card use is evolving rapidly. The business cases and the terms used to describe them sometimes overlap and sometimes the lines between payments, online banking, virtual cards and wallets are so blurry it is hard to place a business or a service firmly within the landscape. We are going to dive into virtual cards and other innovations that support the advent of this virtual economy.

Have you heard of virtual cards?

Virtual cards have been around for a few years now. Their mainstream use is mostly the result of emerging technologies like virtual wallets, challenger banks and payment accounts.

Virtual wallets like Apple Pay, Google Pay, Samsung Pay to name a few allow users to use their existing physical cards but rather than carry around a card, users can use their cards over their phone’s NFC sensors. Recently, virtual wallets have found some success in wearables with the likes of Apple Pay and Garmin Pay for smart watches. These are linked to actual physical cards which need to be activated in traditional ways like online activation or an ATM withdrawal.

Challenger banks and payment accounts like Revolut, Monese, Wirex, etc., on the other hand began to offer a new type of card which is virtual only. These cards are created and delivered to end users via an app and can be used immediately. They have some interesting advantages over traditional cards but are so far also limited to an extent. The last type of card available is the so-called disposable card. This type of card is an extension of the virtual card with a unique security feature to further protect the user from falling victim to fraud.

All of these advances have some great implications for users who need more and more flexibility when it comes to their money and payments. This flexibility extends into the way users store and use the new virtual payment methods, in comes the virtual wallet to the rescue.

Virtualized wallets

A virtual wallet allows you to store your existing credit cards and other virtual items like loyalty cards, coupons and boarding passes. In terms of credit cards, virtual wallets have typically only allowed users to import an existing credit card, we’ll call these “Virtualized cards”.

Virtual wallets are excellent when you own many cards and don’t want to carry all of them around. They work well in places where credit card payment methods are widely available and of course, where the POS terminals are equipped with contactless NFC scanners. The adoption of NFC enabled POS terminals varies from country to country. In some places however, you will still find that cash is king. You can learn more about mobile payments in our mobile payments post.

Another argument we often hear about virtual wallets is that your phone might run out of battery, which is inconvenient and could leave you stranded without money. Unified charging ports and improved battery life will probably mitigate this limitation over time.

For now, virtual wallets mostly allow enrollment of actual physical cards that are NFC enabled. The other limitation is that some virtual wallets are not enabled in all countries globally and on all devices. The technology is catching up to the software. Virtual wallets are being used more as an increasing number of card issuers start to offer virtual cards and the usefulness of the virtual card increases, for example, NFC enabled ATMs are becoming more common. Users can lighten the load they have to carry around by filling their virtual wallets with virtual cards.

Virtual cards

Challenger banks and payment card providers usually offer physical cards and virtual cards. The physical cards are virtualized immediately but will often require you to activate the physical card once received.

The limitation of virtual-only cards is that sometimes they cannot be used for anything other than online credit card payments. This limitation does not seem too bad when taking into consideration that we have experience a dramatic increase in online shopping and that virtually every online merchant accepts Visa or Mastercard, which are the two top issuers of virtual credit cards.

The great thing about virtual-only cards is that they are fast and easy to get and that users can usually change their settings in real time. One of their current limitations is that not all of them can be used for POS payments and ATM withdrawals.

Virtual disposable cards

A sub-type of a virtual card is the virtual disposable card. The unique feature of these cards is a dynamic card number that is set up to change after every payment transaction is completed.

Disposable cards are great when doing business with a merchant you might not know and trust well enough or when you want to preserve some privacy. A disposable card will allow you to only use the credit card details for a certain number of payments. Most often the details will be disposed of after one payment. After that condition is met, the card will be void and nobody will be able to use it in any way. This makes them resilient to unauthorized charges at any later time.

These are only useful for one-time purchases. If you plan to pay multiple times or subscribe with a card like this, your future payments will not be processed and you will likely lose access to a service.

Security as a key benefit

Just as you should be mindful of your online safety and data, the same holds true for your credit card data. Luckily, virtual cards along with virtual wallets and payment apps take your security to heart by making it virtually impossible to have your credit card data stolen or defrauded. First off, any app that supports a credit card will require a user to authenticate first. This means that it is very likely that in order to use a card you will need to unlock your phone and then also your app. If you are using biometrics, the likelihood that anyone other than you can use your virtual card is greatly reduced while adding convenience to you.

Some wallets and apps allow users to change their physical or virtual card settings in real time. Some of the settings we have seen so far are enabling or disabling ATM withdrawals, online payments and POS payments. Some apps also allow you to disable the magnetic strip. We have also seen the option to change the card’s PIN code in the companion app, which empowers and secures the user even further.

All of this means that you can, for example, decide to use a certain card only for paying online. In that case you could turn off ATM withdrawals and POS payments and make the card more secure.

Most apps allow you to freeze a card which means that the card can’t be used without unfreezing it first. Cards with companion apps also have an added convenience that reporting an unknown transaction is quick and simple and when a card is lost, it can be reported lost or stolen immediately.

Other benefits

Beyond the state of the art security features that come built into the virtual card ecosystem, there are some other really handy user features to point out, many of which have been driven by millennial FinTech adoption. Some virtual wallets and some companion apps usually allow users to track their spending. This can be done in a variety of ways. Almost all applications can show you your spending patterns via graphs and merchant breakdowns or a variety of other parameters. Many apps also allow users to set limits for single transactions and to limit the amount spent over a certain time (week/month).

Other interesting features that we have seen so far are savings accounts which allow users to act as a kind of savings bank account. Another interesting feature related to savings is when users can set a certain amount after each payment to go into a saving account separate from the spending balance.

Another important benefit of many of these apps is that some are completely free. Most virtual wallets are free to use while challenger and payment apps usually offer free and subscription based accounts which can have added perks like custom physical cards, cashback, concierge, cryptocurrency exchange, etc.

As mentioned before, virtual cards can be issued almost instantly. This is particularly helpful for the disbursement of relief funds in areas affected by natural disasters, civil unrest, widespread disease, etc. Unlike physical cards, which can take weeks to be put through the supply chain and into the hands of the end user, virtual cards can be issued in mass quantities, preloaded with funds, and ready to be used in a matter of seconds.

Lastly, virtual cards put a much smaller strain on the environment compared to physical cards which makes them more eco-friendly. They are also more hygienic because of their contactless nature.

A bright future ahead

We can imagine that the future holds exciting new options for credit card users. One potential breakthrough that stands out for us at GateHub is the option to go fully virtual with credit cards. Waste and delays can be eliminated for consumers and costs can be reduced for providers.

Virtual cards still have a long way to go to be considered mainstream. The first step towards this goal is to make all virtual-only cards eligible for POS payments and ATM withdrawals. They are already easier to acquire than most physical credit cards.

We believe that virtual-only cards are the future of payments and that we will see expanded possibilities soon.

Conclusion

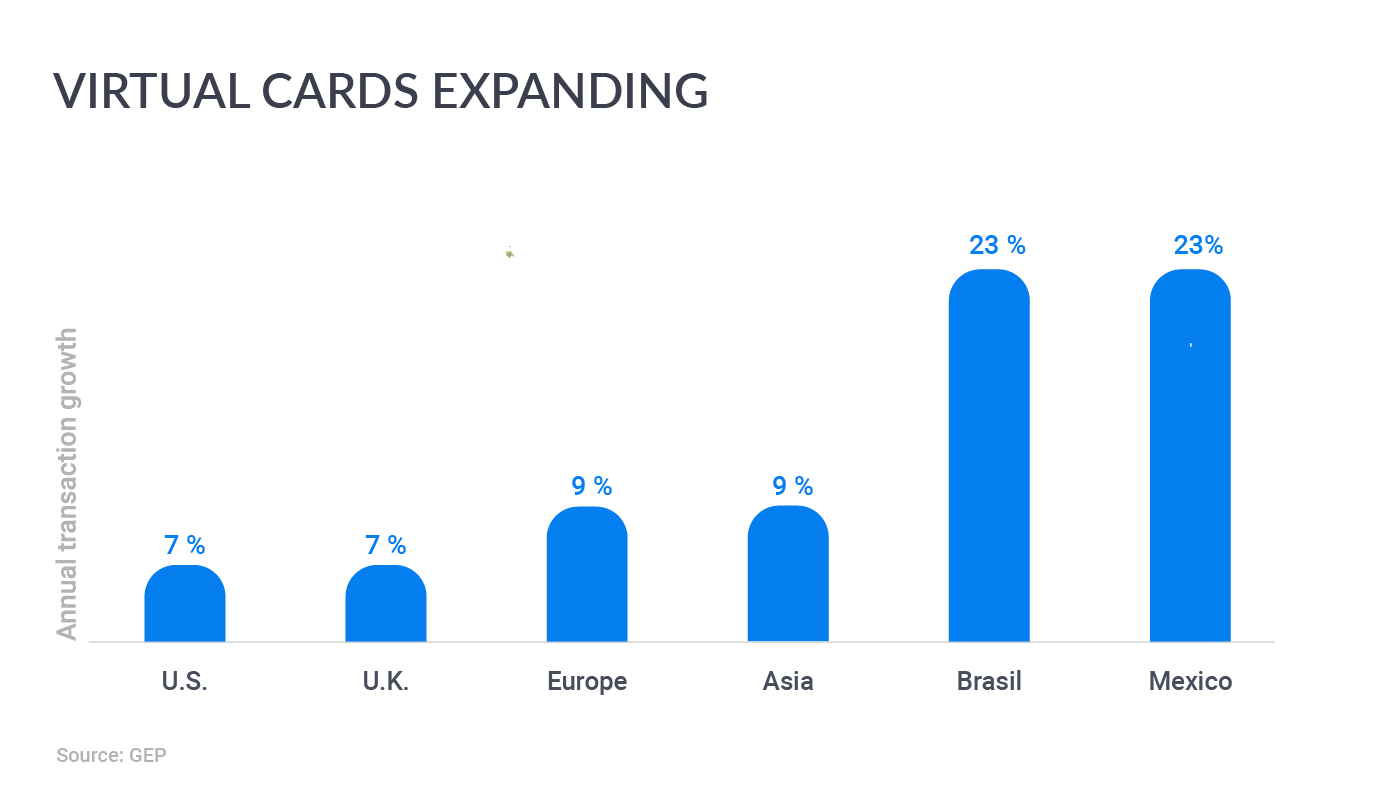

Some statistics say that virtual cards have not made it into the mainstream yet. In the USA, for example, physical cards make up 44% of Amazon’s online payments. That being said, Amazon is also the #1 virtual card vendor in 28 states. Nevertheless, virtual cards are expanding, especially in Latin America where annual transaction growth has risen by 23% while the expansion elsewhere is more even, as you can see in the graph below.

We can conclude that cards can be utilized in many ways. The extent of its utility can most often be measured by the strength of the accompanying application. When using a virtualized card, you are most often limited to what the card can do out-of-the-box.

If you received the card from an issuer who also provides a companion app, your options are usually extended to enhanced security features and spend tracking. There are many options available right now and we are certain that even more will be available soon.