Central bank digital currencies have been making headlines lately. The promise of blockchain technology is more transparency, more security and lower costs. Banks have also recognized that they can’t delay their digital transformation any further and have begun offering more digital and more convenient solutions than ever before. The logical next step is an upgrade of the nature of currency as we know it from analogue to digital. Here’s what you need to know about central bank digital currencies or CBDCs.

What is a CBDC?

It’s a digital currency that uses electronic records to represent a virtual form of fiat currencies of a particular region or sovereign state. Like it’s analogue counterpart it is issued by a central authority - a central bank, like it’s name suggests - and can be manipulated in certain regulated ways by said authority.

A CBDC will be a high-security digital instrument - like paper notes - acting as a means of payment, unit of account and store of value. Each unit will be uniquely identifiable, just like paper currency to prevent counterfeit. It will be a part of the base money supply together with other forms of the currency that we already know today (paper notes, bonds, etc.).

How do CBDCs work?

No CBDC has officially been launched yet so we can only speculate but there are various possible scenarios on how CBDCs will come to life.

They could use existing blockchain networks to add CBDCs as tokens and utilize the infrastructure that is already available. This approach would be similar to how Tether and other stablecoin providers are representing value on existing rails.

Another possible approach is to fork existing technology to build in more regulation, privacy, security and control into the system. The promise of blockchain is the privacy and decentralization of authority which is one of its key propositions compared to traditional money. It is unlikely that CBDCs will exist on decentralized and trustless chains.

There is also a possibility that CBDCs will be built on a completely new blockchain which raises similar questions as the previous scenario.

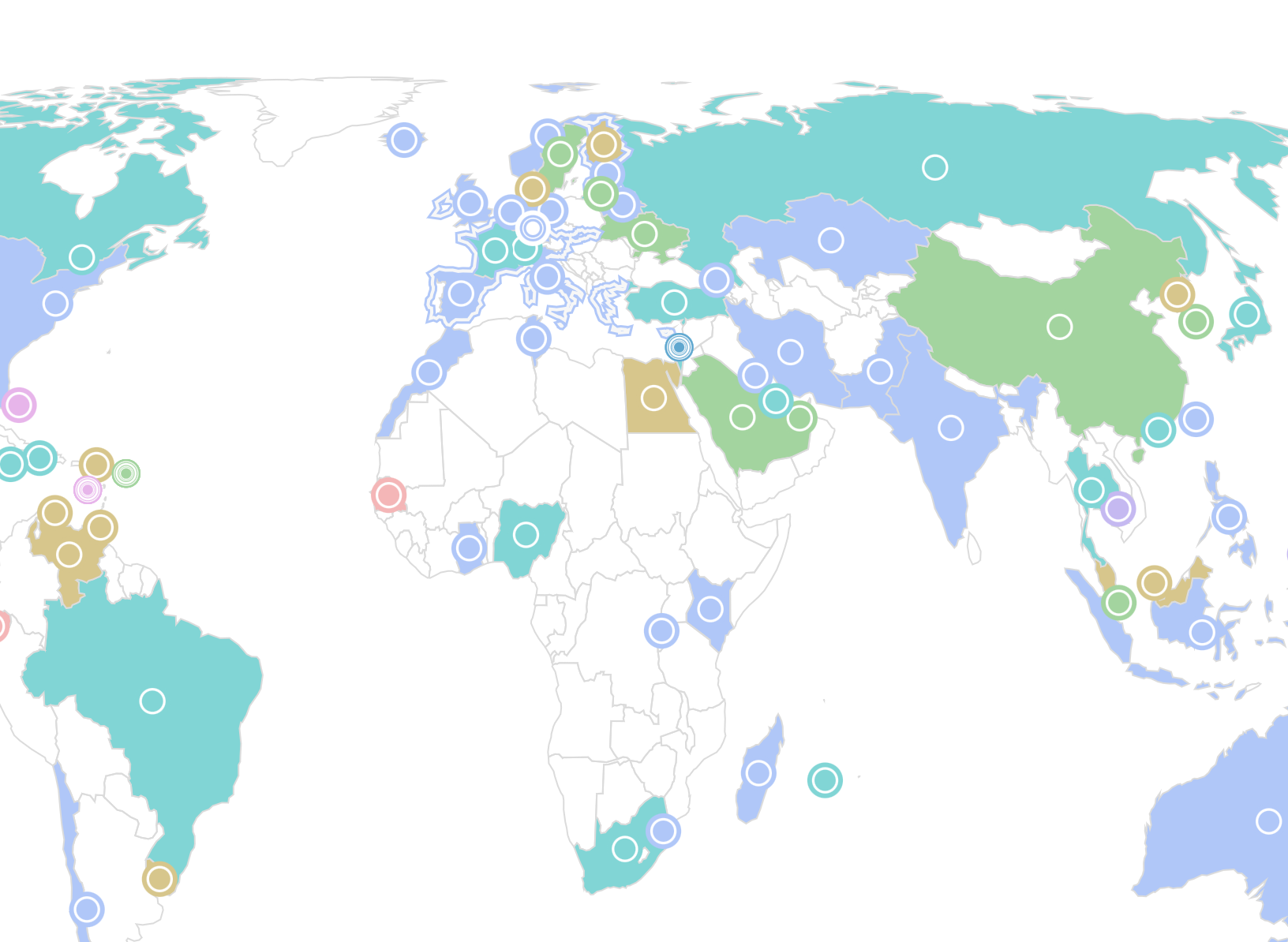

Here’s a handy tool for tracking the status and specifics of CBDCs around the world:

What are the advantages of CBDCs?

Like any previous endeavor to digitize an existing medium, there are obvious advantages to digitalization of money and money services. Digital solutions in general require fewer resources and have better speed, reliability, cost-effectiveness and trackability.

The promise of CBDCs is to bring together the convenience and security of digital, cryptography supported systems and the dependability of regulated, reserve-backed money to the banking system. They promise to improve efficiency by reducing the need for intermediaries, reducing the risk, complexity and cost of transactions, improving inclusion, preventing illicit activity, and establishing a formal record of all transactions for more transparency.

On an institutional level CBDC can be available for transacting 24/7 to reduce counterparty credit risk. The current payment models between two jurisdictions depend on central bank settlement, while CBDCs could open the gates to operating real-time gross settlement (RTGS) infrastructure within which all local banks’ obligations could be settled atomically. Because of the time lags in international transactions today with net settlement, parties are exposed to credit risk and settlement.

As we already mentioned, CBDC is a digital form of the country’s official fiat money and it’s also a claim on the central bank. The central bank issues coins or accounts in electronic shape that are backed by the government. That way a central bank digital currency or CBDC would allow anyone to make instant electronic payments with money that was issued by the bank.

How do CBDCs differ from cryptocurrencies?

In principle CBDCs and cryptocurrencies could use the same underlying technology using cryptographic proofs to validate new transactions. This would make the distinction between the two very difficult. There are two main separators all the same.

Central vs decentralized authority

As explained in brief above - and in one of our previous blogs - cryptocurrencies like Bitcoin, Ethereum, XRP and others use a decentralized set of nodes that are independent of each other and of a central authority to validate new transactions. When the majority of these nodes act in a non-malicious way the network is stable and new transactions can enter the ledger of transactions. The main value proposition of such a system is that there is no central authority that can decide what does and what doesn’t get processed.

This is not true when it comes to fiat money. A bank has certain checks in place to ensure that suspicious transactions are blocked. Traditional money can also be seized by authorities and there exists a plethora of checks that dictate what you can and cannot do with money. Physical money (bills, coins) can circulate freely, but they are hard to move over large distances and anonymously. CBDCs will very likely eliminate this last limitation and make it easier to move money across the globe instantly and with low costs. The downside could be that there is even more control over the money that you hold on a system with built-in checks and a potential to censor, discriminate and withhold your money.

Volatility

Like stablecoins that have become a staple of the cryptocurrency space, CBDCs will hold a stable value backed by a supply of monetary reserves like gold and foreign currency reserves. The benefit for end users is that such a currency should be easily accessible and easy and cheap to transfer and utilize. CBDCs could have some upsides but so far we have not seen any moves towards using CBDCs to stabilize inflation which seems to be one of the main issues of fiat money from the perspective of blockchain’s predictable supply approaches and from some of the recent financial crises.

The value of cryptocurrencies still stems from speculation almost entirely. Still, cryptocurrencies promise to become more valuable over time, assuming some basic factors like network stability and security, adoption and continued technological progress. As an investment instrument, cryptocurrencies are a high risk asset class and exceptional volatility upwards and downwards is very common.

A CBDC is expected to be designed as a stable unit of account on a digital ledger. Cryptocurrency on the other hand promises to deliver more value over time through tangible and intangible advantages like decentralization, steady supply, privacy and others.

What’s the difference between CBDCs and stablecoins?

As explained above and in our previous blog, stablecoins are issued by a central authority that controls their supply and backing mechanism. Stablecoins are largely unregulated and can in theory be issued by any legal entity. They are issued on an existing blockchain for the convenience of the issuer and its users and because the rules are less stringent. Their value is stable, except in extreme cases of crypto volatility or legal pressure on the issuer. Their price reflects the value of the real asset they are representing but it is highly unlikely they will ever act analogously to money in the real world.

CBDCs have more strings attached to their supply and value and their issuer can only be a government appointed entity like a central bank. When they are in fact released into the wild they will act as money and will be used as actual legal tender just like coins and bills in the real world.

Are CBDCs the future?

We know that decentralized blockchains today operate in a trustless and irreversible way. This is not an option for a CBDCs as they will need to operate within the same legal frameworks as the current money system with strong authentication, management and legal mechanisms.

One of blockchain’s goals is to improve (in extreme cases to replace) the existing money systems. CBDCs will pave the way for digitalization of fiat currency but by themselves, they do not address any of the concerns raised by Bitcoin and other more recent blockchain based projects. They might help lead the way to more adoption of blockchain if the underlying technologies are able to operate together. The digitalization could also bring more transparency and new or improved financial instruments through smart contracts and other mechanisms enabled by blockchain but it is unlikely that CBDCs will run on public ledgers in any case.

It is unclear whether CBDCs and the accompanying regulation will lead to more adoption and better applications for cryptocurrency or hurt cryptocurrency with rigid interoperability and more demanding regulation.

Some reports say that over 80% of central banks are exploring the possibility of them issuing a CBDC.

In conclusion

It is evident from the sentiment arising from the blockchain space that the traditional money markets are broken in more ways than one, especially for individuals who want to participate. There are pressing questions of trust, transparency, accessibility, accountability and more as past financial crises have shown. Many projects in blockchain aim to solve these issues but the openness and loose regulation of the crypto (and DeFi) market is highly susceptible to fraud in the form of scams, various types of theft and hacks, volatility induced losses by investors, etc. The market is also highly accessible which means that on one hand, money can be gained by anyone but on the flip side it can also be lost just as quickly.

There is a simultaneous need and resistance to more regulation which makes the industry extremely sensitive to change. The introduction of CBDCs in any form and any accompanying regulation is an opaque area at the moment and we’ll just have to wait and see what happens when we have centralized fiat currency mingling with the likes of Bitcoin, Ethereum and other disrupting technologies.